Learn more about Important service updates from Element

Operations alert and response center

From weather emergencies to supply chain disruptions and more, Element Fleet Management has you covered. We actively monitor emergencies and service interruptions so our experts can help keep your fleet ahead of the pack.

Jump to

As news on tariffs continues to evolve at a rapid pace, we will update this page with insights and information important to our clients and the fleet and mobility industry.

On March 26, the U.S. government confirmed a plan to impose a 25 percent tariff on cars and parts imported through the United States, which will take effect April 2. We encourage you to read our blog for additional insights and information.

Fleet management impacts of steel and aluminum tariffs

Published February 11, 2025

The steel and aluminum tariffs announced by President Trump, which are effective March 4, are expected to have additional repercussions, particularly if they end up stacked atop the Canadian and Mexican tariffs which are currently set to take effect on March 1.

The automotive and fleet management industries may face the following impacts:

- Increased Costs and Vehicle Prices: While much of the steel that auto manufacturers use is produced in the United States, they also depend on specialized alloys that are only available from other international producers. A 25% tariff on steel and aluminum imports will raise material costs, leading to higher vehicle production expenses. Based on metal weight and cost per ton, prices may increase upwards of $500 USD on vehicles including trucks, truck bodies, and aftermarket equipment. For cars manufactured in Canada and Mexico, there would be no impact to pricing.

- Production Disruptions: Tariffs may disrupt supply chains heavily reliant on North American manufacturing, potentially reducing production by up to 30% for certain vehicles. In addition, delays in raw material availability could extend vehicle delivery timelines.

- Global Stock Changes: The announcement has already triggered a decline in global auto stocks, reflecting investor concerns about trade conflicts and supply chain disruptions; with that, there has also been an increase in the stocks of U.S. metals processors.

- Vehicle orders and pricing: Given OEMs review their pricing continuously we may see price increases to MSRP. In addition, in response to the tariffs, vendors may shorten quote expiration periods due to fluctuating material costs.

Keeping you informed:

Given the evolving landscape, we will continue to monitor the impacts of tariffs as they are fluid. We continue to stay informed on these changes, and how they impact you, your organizations, and your business. We will ensure to provide updates frequently, along with our recommendations. Please continue to visit our Operations Alert and Response Centre on our website, for the most up-to-date information as the situation continues to evolve.

Impact of Tariffs on Fleet Managers

Published February 3, 2025

The recently announced tariffs, which are currently paused for 30 days, bring with them an increasingly complex landscape with the potential for increased costs, supply chain disruptions, price volatility, and additional uncertainty. As your strategic fleet management partners, we are closely monitoring this rapidly evolving situation and are committed to keeping you updated.

Overview of key risks

Although Mexico and the U.S. have agreed to put tariffs on hold for one-month, similar implications would apply to goods from Mexico, should a tariff be enacted.

Increased Costs

The proposed 25% tariffs on goods from Canada could significantly raise costs for fleet operators, especially for vehicles and parts imported from these countries.

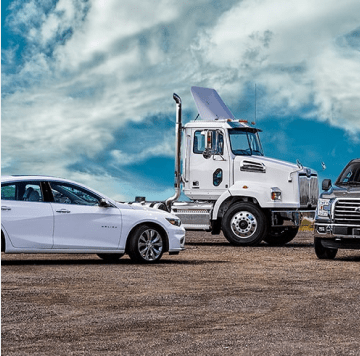

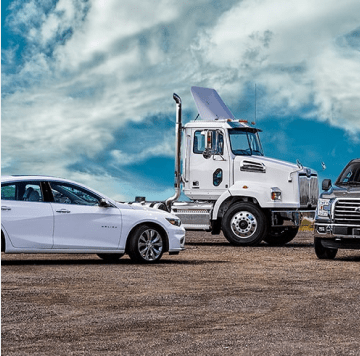

Once in effect, the tariffs would have broad impact on acquisition costs for new vehicles; of the U.S. market’s 50 best-selling models, which account for approximately 60% of the market volume, half will be directly impacted.

Tariffs will raise the cost of vehicles imported from Canada by up to 25%, with price increases of $5,800USD or more for a $25,000 vehicle. This will affect fleets relying on affordable light-duty trucks and SUVs like the Chevy Silverado, Ford Maverick, and Toyota RAV4.

These metrics do not account for the impact on associated maintenance fees for auto parts that currently move freely across the Canada, U.S. and Mexico borders today

Supply Chain Disruptions

Tariffs can disrupt established supply chains, leading to delays and increased shipping costs. Fleet managers may face challenges in sourcing vehicles, and higher prices for automotive parts sourced from Canada, which are integral to U.S. vehicle production which could affect vehicle availability and operational efficiency.

Fuel Price Volatility

With Canada being a major supplier of crude oil to the U.S., tariffs could lead to increased fuel prices, impacting overall operational costs for fleets that rely heavily on fuel. Analysts predict potential hikes in gasoline prices by 40 to 70 cents per gallon due to these tariffs.

Resale Value Fluctuations

As new vehicle prices rise due to tariffs, resale value of used vehicles may increase if there is a drop in new vehicle purchases, tightening the supply of used vehicles hitting the secondary market and offering some potential upside.

Retaliatory Tariffs

Canada has announced retaliatory measures, potentially increasing costs further for U.S.-based fleets operating internationally.

Economic Uncertainty

The broader economic implications of tariffs can lead to uncertainty in market conditions, affecting demand for goods and services. This uncertainty can complicate fleet planning and investment decisions.

How Element is supporting you in mitigating these risks

As your strategic partners and as a global leader in fleet management, Element is committed to supporting you as this situation develops, leveraging our global reach and deep industry connections.

Domestic sourcing

in the U.S.: Our team will aim to prioritize U.S.-based suppliers to avoid tariff-related costs and is actively mapping vehicle manufacturing locations and component input origins to minimize impact where possible.

In Canada: Our team will follow similar approach as above, prioritizing Canada-based suppliers to avoid tariff-related costs and is actively mapping vehicle manufacturing locations and component input origins to minimize impact where possible.

More to come

We are committed to providing you with relevant, up-to-date information to help you in navigating your fleet management needs during this time. Please continue to check back here for the most up-to-date information as the situation continues to evolve.

Original equipment manufacturers (OEMs)

We continuously monitor vehicle supply chain impacts and will update our clients with critical information as it becomes available.

- Visit our Motor company information page for the latest vehicle production start-ups and build-outs, as well as recalls.

- For the most recent, direct-from-OEM information, visit their websites:

GM | Ford | Stellantis | Toyota | Nissan | Kia | BMW | Subaru | Hyundai | Tesla

Fuel stations and maintenance shops

Fleet drivers should use our Supplier Locator to find fuel stations and repair shops in their area. In the event of natural disasters and other unforeseen circumstances, fuel stations and maintenance shops may close or adjust their hours. Check the last updated information under details. Those with updates over 24 hours old are likely not viable options.